5 proven ways to get funding for your startup business

Boohoo, you've got a great startup idea, and you are trying to figure out how to find reliable funds to kick start. You have probably gone through the market research, business plan, and “gathering your team” stages as you have come this far. So keep it up; now, we will get to discover the most famous ways to fund your business and skyrocket. You might have probably surfed the net and came across lots of theoretical data on funding. Of course, it is worthwhile to know the classical theories, but practical tips are here to last.

The first thing that might have come to your mind when looking for funding is most probably bank loans. However, we all know the hurdles on our way to getting approved. It might take months and a gazillion amount of paperwork. This time, we will not focus on loans as a way of startup funding, as loan policies are closely dependent on the country’s economic policies you are working in now. Instead, we will work through the other proven ways to get funding. So let’s get into it.

1. Bootstrapping or self-funding

Bootstrapping is all about self-funding: scraping together all your savings. So why is starting with bootstrapping considered to be a good option? Because later on, when hunting for investors, you will have established your own feet on the ground and good ties to your business.

Self-funding enforces your imagination and fosters creativity. Remember the caveman who had no support and food delivery services? All they had to do was hunt the dangerous species of animals for potential food. What do we have today because of their persistence? Grocery shops and lots of food to consume. So when you rely on yourself in a tense environment, you will surely figure out your first funding.

Besides developing creativity, bootstrapping "teaches" you how to manage your company's money quite efficiently, and you are not accountable to investors. Well, you are responsible, but only for yourself. With this level of financial independence, you quickly turn into a customer-oriented team as your priority is not your investors but the customers themselves. You will learn the essence of serving the clients appropriately and will grow your customer base in no time.

With all these inherent advantages, bootstrapping is not always a good option if you are a type of company that needs large amounts of investment. However, self-funding can work, for instance, as a small locally targeted startup that starts with developing small mobile apps, then moves forward by engaging investors on the go and adding up extra features. This is a proven way to test the waters for your business idea before planning to roll it out internationally.

Wonder if any world-known companies have started out by self-funding? Yes, sure they have: Amazon, Apple, HP, and Disney have all bootstrapped their way from a small garage to going global.

A small helpful tip: If you are bootstrapping and sure that you will be looking for investors, in the long run, start recording your weekly or monthly mini-success stories and save them up for the future pitch to investors. You may record a video of yourself telling your monthly goals and how you have achieved them and save either in private or post on your company’s social media platforms. The chances are that you might get noticed by investors.

2. Finding Angel Investors

Angel investors are individuals with extra cash and considerable interest in investing in innovative startups. Angel investors usually network with each other to conduct the initial screening before choosing to invest. These individuals are watching out for great ideas to invest in. By the way, you can also keep your fingers on the pulse: this list might give you loads of inspiration for current startups.

The hunt for an angel investor looks like sales targeting: you set up your ‘’buyer’’ (investor) persona profile and start looking around. First, it is essential to define how much investment you need at the early stages of your startup launching. Next, you should remember a ‘’typical’’ angel investor:

- will invest at least $150.000

- monitors your growth and mentors you along the way

- can invest up to 7 years

-most commonly is 40-60 years of age

-iIs familiar with your industry

A significant advantage of getting angel investors is the mentoring and business advice to novice entrepreneurs. As the name implies, angels are highly invested in helping you successfully take off and roll out quickly. Even if their investment capital is less than those of venture capitalists, you receive lots of expert advice and monitoring when taking your first steps.

One of the proven ways to be seen around is through networking.Angel investment is quite a risky business, so you need to have a vast and robust network that can refer a potential investor to you. Many experienced entrepreneurs and business owners have a high potential to invest in an early-stage startup. So, pave your way to angel investors by attending industry-specific networking events or directly look for investors in your local chamber of commerce.

Apart from networking, you can also opt for online services that connect angel investors with entrepreneurs. Try surfing the net, look for reviews of the services, check the waters and start reaching out. A starting point suggested by Cypress could be Angel Capital Association and Angel Forum.

3. Business incubators

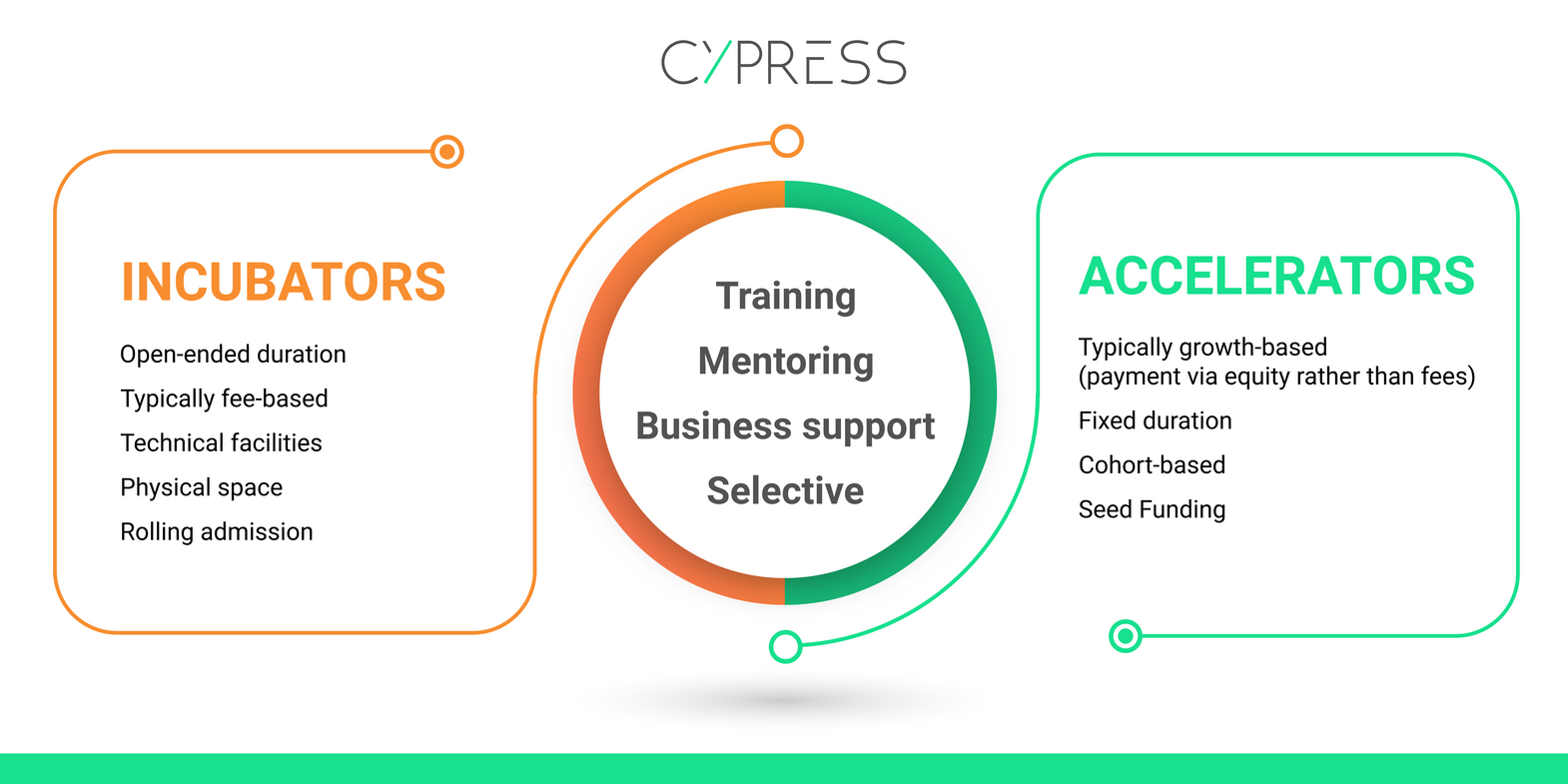

As you have decided to go into the entrepreneurial field, the chances are high that you are familiar with such terms as business incubators and acceleration programs. If you plan to speed up your company's growth, you can opt for business incubators. These are organizations that design special programs to help small startups grow and succeed. Business incubators can stay up to 4 months to ensure you have reached the goals you have set. Being at an early stage is not a must for business incubators, as they invest in your business at any stage. You can have launched your project for quite a long time and still be eligible for incubator funding.

When to Choose a Business Incubator:

- when you need a mentor to draft out the business model and your plans for further growth.

- you are sure their mentor has experience relevant to your niche.

4. Startup Accelerator programs

Accelerator programs are short-term programs that work like boot camps. A list of benefits from accelerator programs will help you test market readiness and reach a level of growth so quickly that it will be equal to the value of year-long growth. To apply for accelerator programs like Y Combinator or Techstars, you will have to go through a thorough application process and appear to be in the 2% of selected applicants. The goal of accelerator programs is to provide you with relevant mentorship, expose you to a broader network and

When to join an Accelerator Program:

- when you are ready for growth

- you have already set up the company structure

- you are ready for networking and mentoring

- you have a market-tested MVP at hand

- you are ready to relocate, as the programs are typically onsite

5. Crowdfunding campaigns

Crowdfunding has recently overfilled the modern business market, and it has turned out to be a pretty effective way of raising funds.

Crowdfunding operates in the flow:

Being a startup owner, you post a detailed description of your business on the desired crowdfunding platform. Remember to mention the goals, plans to make a profit, and the amount of funding you apply for. Consumers or the public on the platform will evaluate your idea based on their likings and contribute with some amount of money.

The process is relatively straightforward but with some nuances: The consumers who have contributed to your business are either promising to buy your product/service or donate. In simpler terms, it is like a pre-order from a group of people simultaneously. However, it is essential to note that you as a founder should have :

- an explicit goal of your business

- a detailed marketing plan

- a financial plan describing how much funding you will need

Here you are competing for the attention of the “crowds” who believe in your product.

Crowdfunding platforms are quite competitive but are worth it. Eventually, even if you don’t get the desired amount of funding, you will have arguments for future strategic decisions. You can mend your product according to the public feedback or terminate and come up with another idea.

In Sum

No matter which way of funding you choose for your startup idea, remember never to give up. You can also share your vision with us, and we will help you create a mobile application for it. Our team is dedicated to guiding your app development from scratch to publication on app platforms. You will have a team caring for your success and treating the project as if it were their own so that you will have the best version possible.

Let’s Discuss Your Ideas!

Fill in the form and we’ll come back to you within 2 business days