ROI Formula: A Detailed Guide on ROI Calculation

ROI (Return on Investment) is the performance measure that is used to evaluate the investment efficiency or compare how efficient a number of different investments are. ROI tends to directly measure the return amount on a particular investment (It may be a specific project), relative to the cost of the investment.

Why is Return on Investment Important?

Probably, the most essential aspect of the ROI is that it quantifies the project value so that we may see it in numbers. Accordingly, business owners get a chance to see currency figures for their project’s worth.

ROI may build stakeholder support. Learning the money value to a project helps to make a “go/no-go” decision. Usually, stakeholders want to know the amount of their dollar value when they are to support any specific project. It would be very difficult to implement without ROI.

Another advantage is that Return on Investment uncovers additional benefits. The process of ROI calculation makes the practitioners find out all the benefits that might not seem obvious at the project beginning.

On the other hand, ROI leads to the prioritization of the project. Once there is a decision to launch a project, ROI plays an important role in determining the ranking of the project among other priorities. It is accepted to believe that projects with greater ROI get a higher rank and gain resource support faster.

How to Calculate the ROI of a Project?

If you have ever wondered how to calculate return on investment then continue reading. You’ll get the answer to your question.

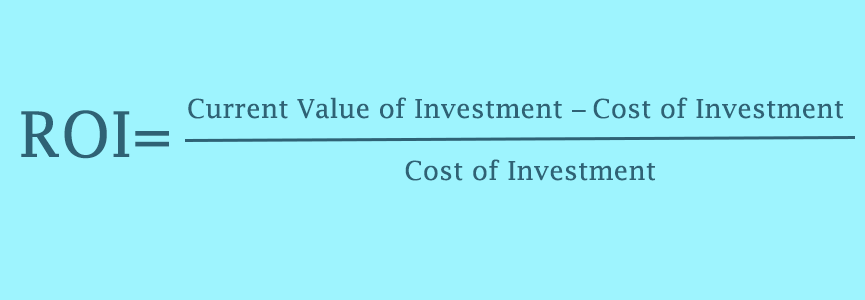

The Return on Investment formula is as introduced in the following image:

Considering the formula, we see that the ROI calculation depends on two components that need to be determined. The first one is the value of the investment that is also called the financial value and the second one is the cost of investment also known as the cost of the project. To shape a clear understanding, let’s see how to calculate these two.

Current Value of Investment / Financial Value

The financial value is project compensation. Sometimes the value estimation may seem somehow complicated because of the uncertainty about assigning an actual value expressed in any currency to a suggested result. The idea is to break the value down into currently familiar components and define them. While quantifying the value of the return on investment formula, you should keep in mind an acronym known as TVD:

T - time

V - volume

D - dollars

Once you define the time, volume, and dollars (or any other currency) required for completing the process, you determine the value of the project. Simply speaking this is the project payback that corresponds to another formula:

TVDPresent – TVDProject

In this formula:

T = Time required for the process

V = Volume or quantity of required units, transactions, people, etc.

D = Dollars or cost required

Present = Current value

Project = Values a successful project will yield

As we understand, it is required to estimate both the current value of the project and also the expenses spent. The difference between the present value and the project value is the financial value.

Cost of Investment / Project Cost

The cost of the project is the second component of the ROI formula. To calculate its value, you need to access revenue information and make a detailed analysis related to the cost using a strategy of breakdown by different categories. This breakdown may be useful in case you want to evaluate different costs aiming at building cost reduction strategies for getting a higher ROI for future projects. Generally, the typical costs pretend the provision of materials, all the expenses for labor and employees, any kind of equipment, and work-related services.

Of course, these factors may vary depending on the type of project. The cost evaluation for a single project ROI analysis will not take into consideration any kind of annual expenses such as the space construction lease or capital investments. The formula covers only the costs related to that single event. Accordingly, you may easily forecast costs and returns having a look back at similar previous events before starting the project. Despite the fact that it isn’t possible to obtain a perfect estimation, keeping the project records gives you a chance to learn an approximate ROI interval depending on the available data.

ROI Calculation for a Project

When you have already calculated the financial value and project costs, it becomes easier to fill in the blanks of the ROI formula. Usually, agencies include this information in an ROI chart. In this way, they show cost versus value over time, as well as the break-even, points the project hits.

Finally, understanding how to implement the ROI calculation for a project is the first step that makes it possible to get a clear image of both the project objectives and benefits. Without ROI, it would be very difficult for the management team to approve the budget that is required for a specific project.

On the other hand, the ROI assessment, regardless of the type of project, allows the project manager or stakeholders to better understand, visualize, and manage the given project from the financial perspective. Yet, it is essential that the project managers fully understand all the elements underlying the ROI calculation. This will help to acquire an accurate picture of the required means and resources, as well as all the advantages and benefits that are expected for the company from it.

Conclusion

So, in order to calculate the project return on investment, first of all, you need to identify the costs and benefits as well as your time expectation about their last. Assess the likelihood of these aspects and determine how much you are going to contrast the expected costs and benefits, not losing money.

ROI is a useful and popular metric thanks to its versatility and simplicity. It is much used as one of the fundamental standards of the profitability of an investment in a project. So, if you want to get a high ROI from your desired project without putting your time, energy, and budget under the risk then fill in the form below and share your ideas. We are always ready to help you choose the best possible solution.

Let’s Discuss Your Ideas!

Fill in the form and we’ll come back to you within 2 business days